how to calculate nj taxable wages

Taxable pensions include all state and local government teachers and federal pensions as well as employee pensions and annuities from the private sector and Keogh plans. Census Bureau Number of cities with local income taxes.

Solved Remove These Wages I Work In New York Ny And

After a few seconds you will be provided with a full breakdown of the tax you are paying.

. Employers must be aware of the taxable wage base per employee and the state unemployment tax rate to calculate the SUTA tax. When you begin to receive distributions they will be reported on Form 1099-R. Taxable Retirement Income.

See What Credits and Deductions Apply to You. New Jersey Paycheck Quick Facts. I have two retirement accounts.

This prorate is New Yorks tax on the double-taxed income. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. The total amount of money paid to an.

How to Calculate Salary After Tax in New Jersey in 2022 Optional Choose Normal View or Full Page view to altr the tax calculator interface to suit your needs Choose your filing status. Total Taxable Wages are all taxable wages reported to the New Jersey Department of Labor by all. The other Ive been contributing into for.

Gross wages are the starting point from which the IRS calculates an individuals tax liability. Income Actually Taxed by Both NJ and Another Jurisdiction Income Taxable in Another Jurisdiction Exempt From Tax in NJ Income must be taxed by bothNew Jersey and the other jurisdiction to be included on Schedule NJ-COJ. Learning how to calculate your taxable income involves knowing what items to include and what to exclude.

New Jersey income tax rate. On your NJ tax return you will recover your contributions tax free. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Either way you will not pay taxes on your contributions again. Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. Ad Calculate your tax refund and file your federal taxes for free.

You must report all payments whether in cash benefits or property. That means that workers who do not earn 134900 in a year will continue to have deductions taken out year round. Also make sure that when you are in the New Jersey return you have reviewed the screen About this W2 income.

The most they can contribute for 2020 is 35074. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. To illustrate say your income for 2021.

If you are a New Jersey resident wages you receive from all employers are subject to New Jersey Income Tax. Enter Your Tax Information. How to calculate taxable wages.

Each state has a standard SUTA tax rate for new employers and it will be different for employers who are in the business for long. Youll need to know your filing status add up all of your sources of income and then subtract any deductions to find your taxable income amount. The Unemployment Trust Fund reserve ratio is calculated as follows.

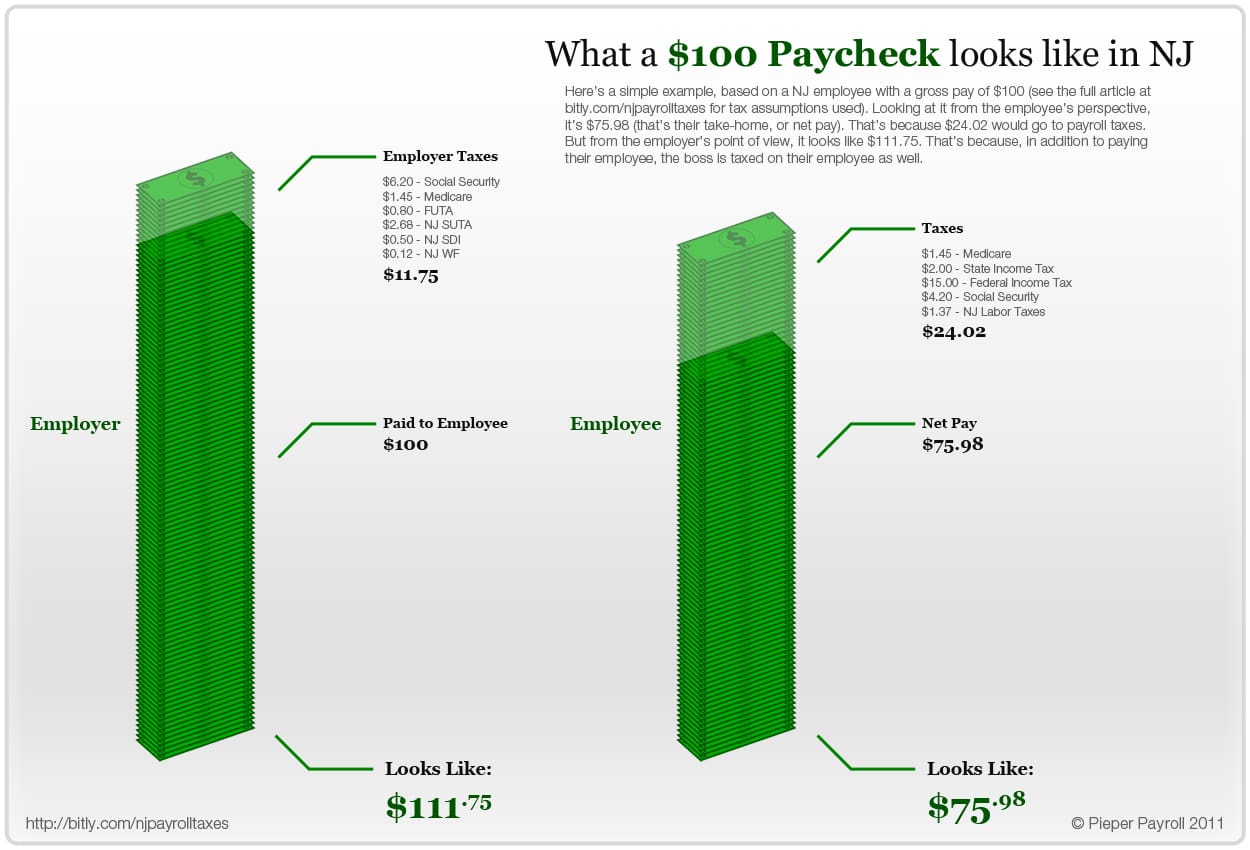

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes Before you can start thinking about New Jersey payroll taxes you need to first calculate federal payroll taxes. Add up all sources of taxable income such as wages from a job income from a side hustle investment returns etc. Simply stated its three steps.

As of January 1 2020 workers contribute 026 of the first 134900 earned during the calendar year. One was pulled from my paycheck before taxes so I know that Ill pay taxes on when I use it. This allows you to review how Federal Tax is calculated and New Jersey State tax is calculated and how those income taxes affect the salary after tax calculation on a 13500000 during the 2022 tax year and historical tax years supported by the New Jersey salary example tool.

Wages include salaries tips fees commissions bonuses and any other payments you receive for services you perform as an employee. 100s of Top Rated Local Professionals Waiting to Help You Today. Balance of Unemployment Trust Fund total taxable wages Unemployment Trust Fund reserve ratio.

The most they can contribute for 2019 is 5848. The table below shows the wage base limit and the SUTA rate for each state. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Employers are required to withhold 22 percent to pay to the IRS. Since your business has. Amounts received as early retirement benefits and amounts reported as pension on Schedule NJK-1 Partnership Return Form NJ-1065 are also taxable.

Calculate Your Gross Income. Balance of Unemployment Trust Fund is the balance in the Fund as of March 31st of the current year. There are two main types of.

New Jerseys credit will be the lower of what New Jersey taxes the double-taxed income or what New York taxes the double-taxed income. For example unemployment compensation may be taxed by another jurisdiction but it is not taxable by New Jersey so you cannot. The filing status affects the Federal and State tax tables.

Using our New Jersey Salary Tax Calculator. The states SUTA wage base is 7000 per employee. You will either be taxed using the Three Year Rule or the General Rule which you will determine when you start collecting the retirement.

NJ Income Tax Wages.

5.jpg)

Set Up Rates And Withholdings Das Drake Accounting How Do I Set Up Tax And Withholding Rates Drake Accounting Gives The User Full Access To Configure Federal State And Local Rates And Withholding Amounts Watch The Setting Up Withholdings

Free New Jersey Payroll Calculator 2022 Nj Tax Rates Onpay

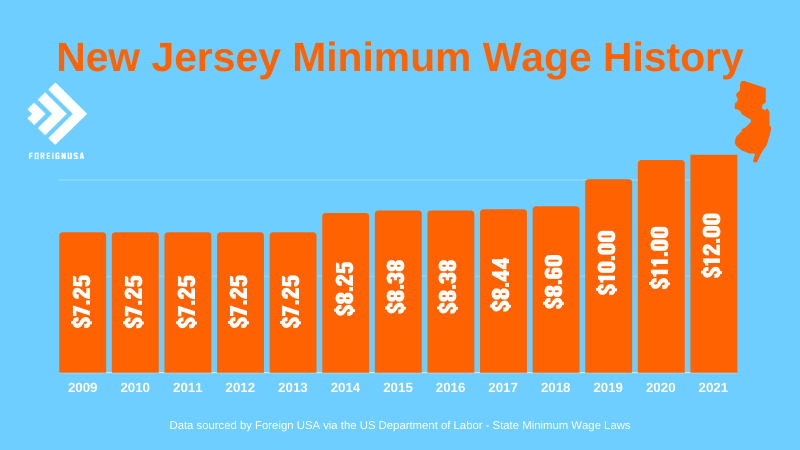

Minimum Wage In New Jersey New Jersey Minimum Wage 2021

New Jersey Nj Tax Rate H R Block

Solved I Live In Nj But Work In Ny How Do I Enter State

New Jersey Tax Rate 2017 Nj Employment Payroll Taxes

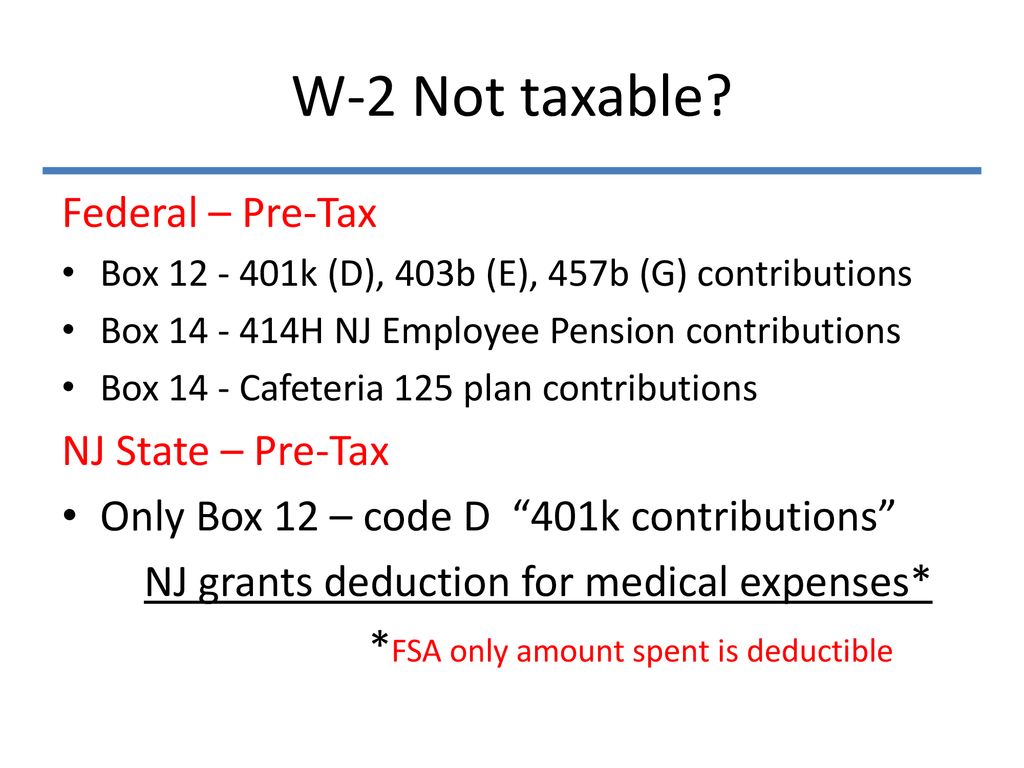

Understanding W 2 Box 1 Federally Taxable Wages Tips And Other Compensation Line 7 On 1040 Box 2 Federal Income Tax Withheld Line 64 On 1040 Box Ppt Download

Nj Minimum Wage Updates For 2021 Abacus Payroll

Cashing In How The New Jersey Minimum Wage Increase Will Affect Tipped Employees Citrin Cooperman

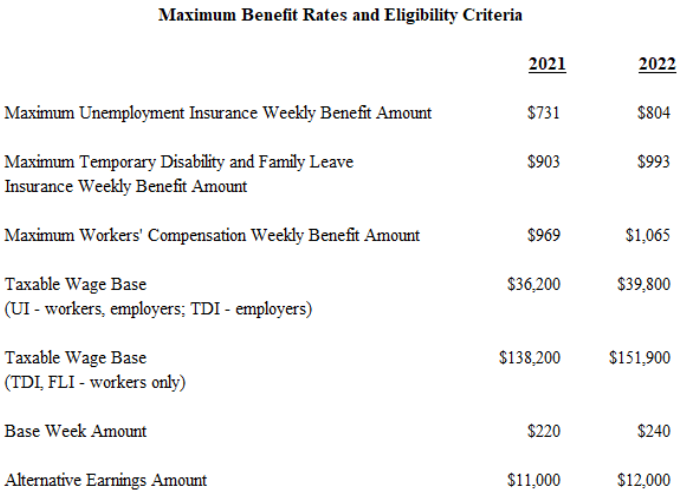

Department Of Labor And Workforce Development Nj Department Of Labor And Workforce Development Announces Benefit Rate Increases For 2022

Understanding W 2 Box 1 Federally Taxable Wages Tips And Other Compensation Line 7 On 1040 Box 2 Federal Income Tax Withheld Line 64 On 1040 Box Ppt Download

Nj Temporary Disability Insurance Rates For 2022 Shelterpoint

Solved I Received State Disability From New Jersey Is That Taxable I Do Not Have A 1099 G I Have A Form W 2 With Money On Number One For Wages

2021 New Jersey Payroll Tax Rates Abacus Payroll

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Aatrix Nj Wage And Tax Formats

New Jersey Minimum Wage Increase Bad For Business Alloy Silverstein