how much is my paycheck after taxes nj

This New Jersey hourly paycheck calculator is perfect for those who are paid on an hourly basis. Calculates Federal FICA Medicare and withholding taxes for all 50 states.

New Jersey Nj Tax Rate H R Block

Taxpayers can choose either itemized deductions or the standard deduction but usually choose whichever results in a higher deduction and therefore lower tax payable.

. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey paycheck calculator. This allows you to review how Federal Tax is calculated and New Jersey State tax is. New Jersey income tax rate.

The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. You can alter the salary example to illustrate a different filing status or show an alternate tax year. And If you decide to live in NYC you will be paying around 3-4 extra in taxes.

How Your Paycheck Works. Under the After Tax Adjustments section select your state or enter your state income tax rate enter any after-tax deductions health insurance premiums dental plan premiums etc. It is not a substitute for the advice of an accountant or other tax professional.

The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. Switch to New Jersey salary calculator. Honestly that pay differential does not seem worth it to have to commute into the city every day regardless of how you will be getting there.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for New Jersey residents only. Calculate your New Jersey net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free New Jersey paycheck calculator. New Jersey has a progressive income tax policy with rates that go all the way up to 1075 for gross income over 5 million.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for New Jersey residents only. The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Jersey State Income Tax Rates and Thresholds in 2022. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Your average tax rate is 222 and your marginal tax rate is 361. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

Census Bureau Number of cities with local income taxes. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay.

Filing 9000000 of earnings will result in of your earnings being taxed as state tax calculation based on 2021 New Jersey State Tax Tables. Switch to New Jersey hourly calculator. This 8500000 Salary Example for New Jersey is based on a single filer with an annual salary of 8500000 filing their 2022 tax return in New Jersey in 2022.

New Jersey Salary Paycheck Calculator. To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. New Jersey 8500000 Salary Example.

For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by 6387. Under the Before Tax Adjustments section enter any qualifying 401k percentage or HSA contribution amounts that are being withheld from your paycheck. Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay.

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare. - New Jersey State Tax.

The paycheck calculator is designed to estimate an employees net pay after adding or deducting things like bonuses overtime and taxes. New Jersey State Payroll Taxes. This results in roughly of your earnings being taxed in total although depending on your situation there may be some other smaller taxes added on.

With this tax method the IRS taxes your bonus at a flat-rate of 25 percent whether you receive 5000 500 or 50 however if your bonus is more than 1 million the tax rate is 396 percent. This marginal tax rate means that your immediate additional income will be taxed at this rate. Tax brackets vary based on filing status and income.

This free easy to use payroll calculator will calculate your take home pay. New Jersey Hourly Paycheck Calculator. The end amount will be more in NY just due to the 9k pay increase but not much more.

Supports hourly salary income and multiple pay frequencies. This results in roughly of your earnings being taxed in total although depending on your situation there may be some other smaller taxes added on. The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare.

It is not a substitute for the advice of an accountant or other tax professional. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Details of the personal income tax rates used in the 2022 New Jersey State Calculator are published below the. New Jersey Paycheck Quick Facts. In many cases the IRS will use the percentage method because your employer will pay your bonus separate from your regular pay.

Aatrix Nj Wage And Tax Formats

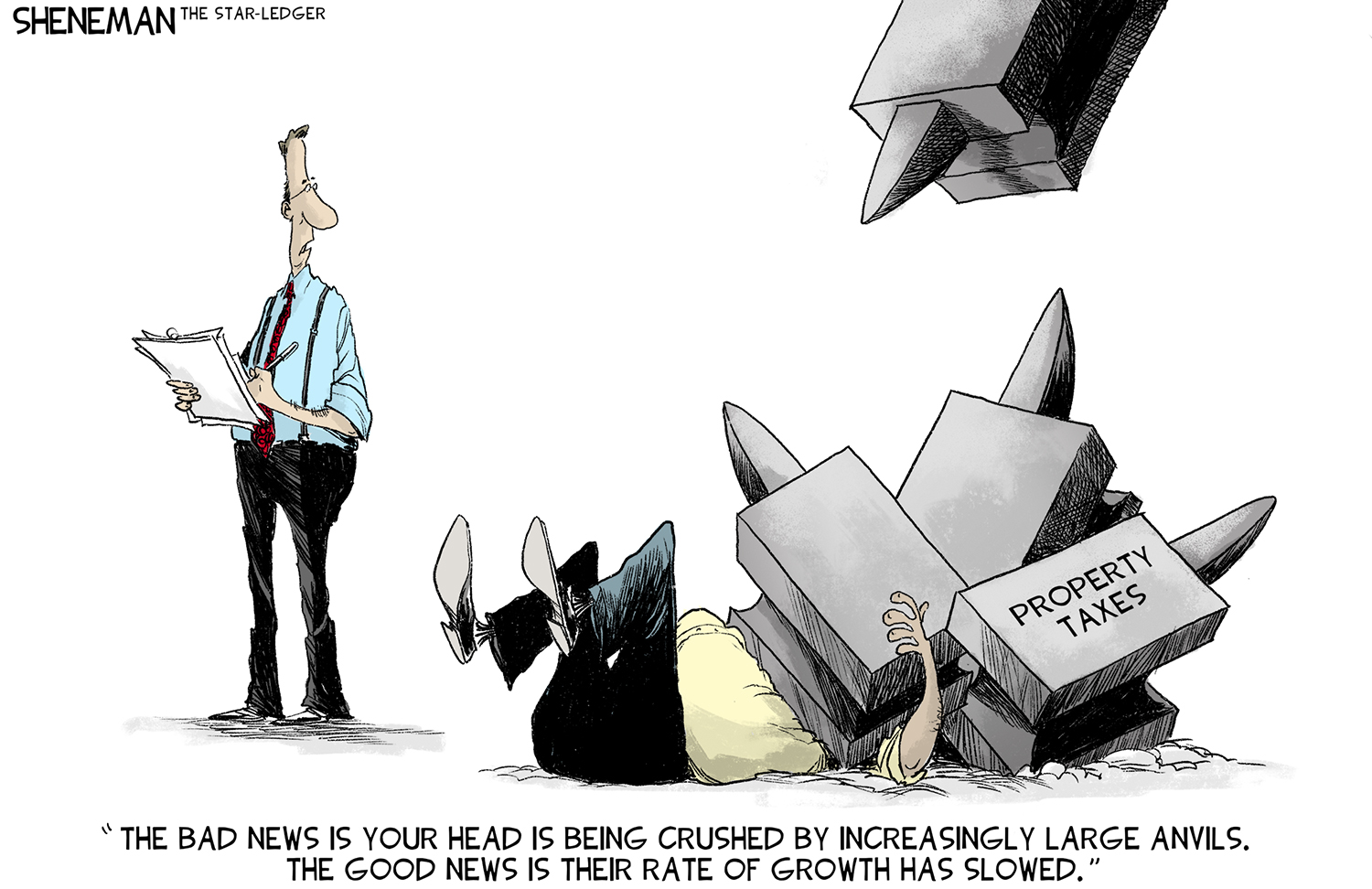

Can Your N J Property Taxes Actually Be Reduced We May Soon Find Out Nj Com

New Jersey Sales Tax Small Business Guide Truic

2022 Federal Payroll Tax Rates Abacus Payroll

Where S My Refund New Jersey H R Block

![]()

New Jersey Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Solved I Live In Nj But Work In Ny How Do I Enter State

New Jersey Retirement Tax Friendliness Smartasset

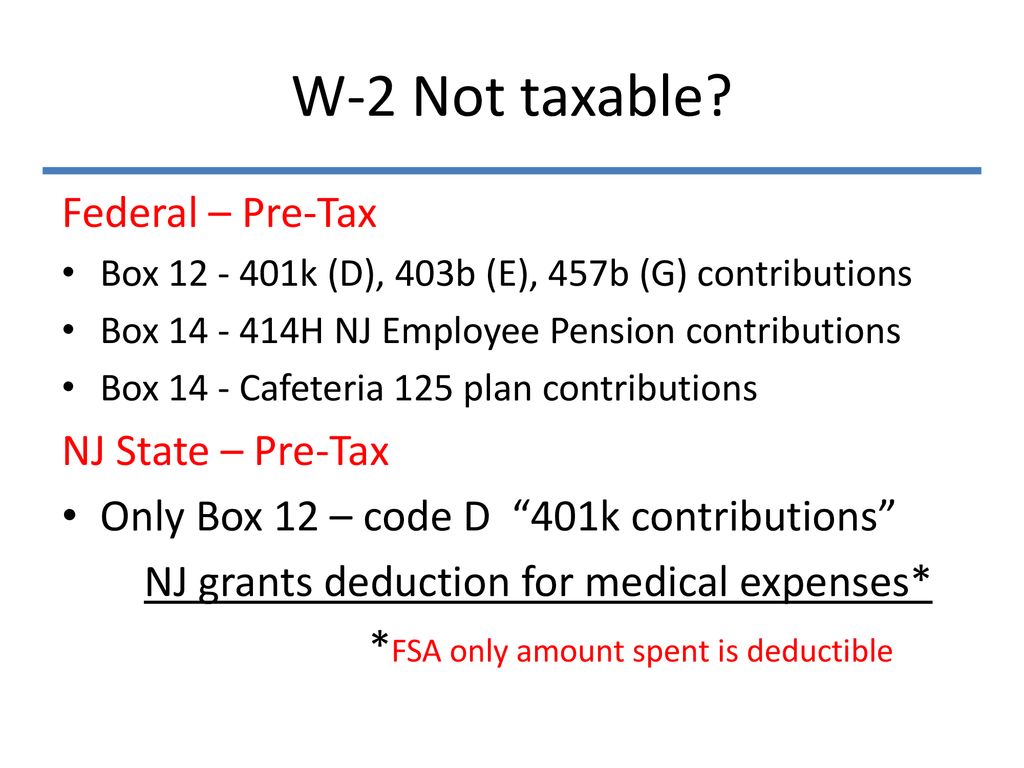

Understanding W 2 Box 1 Federally Taxable Wages Tips And Other Compensation Line 7 On 1040 Box 2 Federal Income Tax Withheld Line 64 On 1040 Box Ppt Download

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

2021 New Jersey Payroll Tax Rates Abacus Payroll

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

California And New Jersey Hsa Tax Return Special Considerations

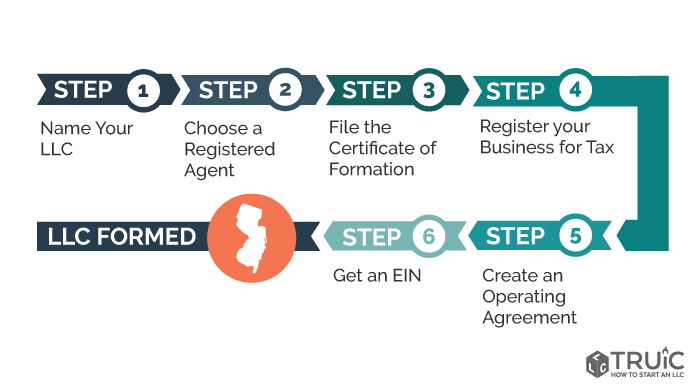

Llc In Nj How To Start An Llc In New Jersey Truic

Solved Remove These Wages I Work In New York Ny And

My Nj Tax Return Not Picking Property Tax Deductio